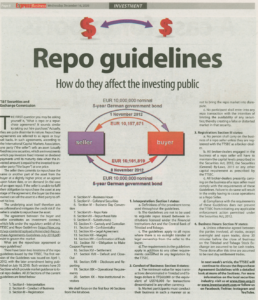

The first question you may be asking yourself is, “What is repo or a repurchase agreement? It sounds similar to taking out hire purchase.” Actually, they are quite dissimilar in nature. Repurchase agreements are referred to as repos or buy/sell backs. In such agreements, according to the International Capital Markets Association, one party (“the seller”) sells an asset (usually fixed-income securities, which are investments which pay investors fixed interest or dividend payments until its maturity date when the invested amount is repaid to the investor) to another party (“the buyer”) at one price. The seller then commits to repurchase the same or another part of the asset from the buyer at a slightly higher price; at an agreed upon future date, or on demand (in the case of an open repo). If the seller is unable to fulfil their obligation to repurchase the asset at any stage of the agreement, the buyer (as the new owner) can sell the asset to a third party to offset his loss. The underlying asset itself therefore acts as collateral and mitigates the credit risk if the seller is unable to repurchase the asset.