Disclosure, Registration and Corporate Finance Division (DR&CF)

The Securities Act 2012 (“the Act”) entrusts the Commission with the responsibility to ensure that the requirements of Section 62 (1) of the Act are duly executed and that “no security shall be distributed or listed with any self-regulatory organization unless it is registered with the Commission”. DR&CF is responsible for the registration of all self-regulatory organisations, broker-dealers, reporting issuers and investment advisers as well as the securities that they provide. This Division:

- Reviews and processes applications of registrants and self-regulatory organizations.

- Reviews documentation to ensure compliance with the law and best practice.

- Approves the contents of prospectuses, offering circulars or any form of solicitation, advertisement or announcement by which securities are offered for sale to the public.

- Reviews filings by all registrants and self-regulatory organizations and assesses among other things the financial solvency of registrants and self-regulatory organizations.

- Maintains a register of securities registered by the Commission.

- Makes recommendations to the Commission for the suspension/revocation of registration when persons no longer satisfy the registration requirements.

- Identifies trends and issues that are likely to have an impact on the securities industry and makes appropriate policy recommendations.

Market Regulation and Surveillance Division (MR&S)

The mandate of the Market Regulation & Surveillance Division is derived from the wider functions of the Commission as contained in Section 6 of the Securities Act, 2012, as amended (“the Act’). This Division:

- Maintains surveillance over the local, regional and international financial sector, (especially in the securities market).

- Ensures that market participants comply with their continuous disclosure obligations and reviews compliance with prudential and reporting standards.

- Conducts inquiries into suspected illegal market manipulation and/or brokerage activities.

- Monitors the operations of all Self-Regulatory Organizations registered by the Commission in order to determine their compliance with the applicable Acts and Rules that govern their participation in the Trinidad and Tobago capital market.

- This Division’s purpose is to monitor the local capital market with a view to fostering compliance with the Securities Act, 2012 as amended and relevant provisions of other subsidiary legislation.

In broad terms, the activities of the Division are geared towards monitoring and evaluating the actions of registered or non-registered entities/persons with a view to determining whether such actions contravened, is contravening or may contravene the Act, any By-laws or other guidance issued by the Commission.

Compliance and Inspections Division (C&I)

This is the newest Division of the Commission, which was established in 2014 as a result of the passage of the Securities Act 2012. Its main responsibilities are to:

- Conduct on-site inspections of registrants and self-regulatory organizations, whether routine, for cause or sweep inspections (registrants include: self-regulatory organizations and persons registered under Part IV of the Act, i.e. broker-dealer, investment adviser, reporting issuer and underwriter);

- Issue compliance directions, thus directing a registrant to take measures that are necessary to remedy any course of conduct that is contrary to generally accepted standards of conduct or prudent operation and behavior; and

- Refer matters for legal enforcement in instances where a person fails to take measures as directed in a compliance direction.

In furtherance of its responsibilities, the Division’s major objectives are to:

- Ensure that registrants are operating in compliance with the legislation;

- Help identify compliance problems and areas of emerging risk, which if they occur can adversely affect investors; and

- Review allegations of improper practices

Legal Division

This Division’s key functions include a focus on the corporate strategic and tactical legal initiatives as well as the management of the Commission’s legal function.

The Legal Division:

- Provides continuing counsel and guidance on legal matters and on legal implications of all matters.

- Serves as key lawyer/legal advisor on all major business transactions, including acquisitions, divestitures and joint ventures.

- Decides on selection, retention, management and evaluation of all external counsel.

- Organises and manages the company’s internal legal function and staff.

- Assumes ultimate responsibility for ensuring that the Commission conducts its business in compliance with applicable laws and regulations.

- Recommends the commencement of investigations of securities law violations, by the Commission.

- Conducts investigations pursuant to Section 150 of the SA 2012 as amended, into market abuse, market manipulation, insider trading and other securities market contraventions.

Policy, Research and Planning Department (PR&P)

The Policy, Research and Planning Department is a centralised function which performs the following:

- Conducts research on matters related to the local and international securities markets;

- Collect and collates financial and statistical data on market activities;

- Utilises data intelligence to analyse and report on the economic and financial issues;

- Monitors the performance of market players and segments;

- Assesses the potential risks posed to the financial system stemming from activities;

- Provides planning and policy formulation capabilities to strengthen the Commission’s capacity to discharge its functions.

The Department has a library that is considered a “Special Library” which houses a collection of books, materials and non-confidential information resources, physical and electronic, on the securities industry and related environments.

Corporate Communication and Education Department (CC&E)

The Department gets its mandate from Section 6 of the Securities Act 2012 and its goal is to educate and promote an understanding by the public of the securities industry and the benefits, risks, and liabilities associated with investing in securities.

The Department’s mission is to promote informed investor decisions and the TTSEC’s role as regulator, through all aspects of Corporate Communication, inclusive of Public Education and External Communication. The Division is also responsible for performing the Commission’s Public Relations, protocol and Crisis Communication functions. In accordance with the IOSCO principles, the Department coordinates a multi-faceted Investor Education programme designed to provide investors and potential investors with suitable information to guide informed decisions.

Information Management Division (IM)

The Information Management Division assesses, develops, manages and supports the technological and data requirements of the Commission’s internal and external users by establishing performance measures, business processes, business continuity planning and support, digital and online communications, telecommunications, enterprise resource planning and project management.

Corporate Services Division (CSD)

The Corporate Services Division is responsible for managing and executing the following functions : administration, property management, procurement, records management, health and safety, fleet management and security services for the Commission.

Records Management Unit (RMU)

The Records Management Unit is responsible for the Commission’s active, inactive and vital records in both the physical and electronic environments. The Records Management Unit is also responsible for maintaining the Commission’s centralized filing system and contributes to the implementation and maintenance of the Commission’s Disaster Preparedness Plan.

Human Resource Division (HR)

The Human Resource Department is responsible for planning and executing a range of human resource strategies with line managers and plans, co-ordinates and implements the human resource management infrastructure that mutually satisfies the corporate objectives and employee needs.

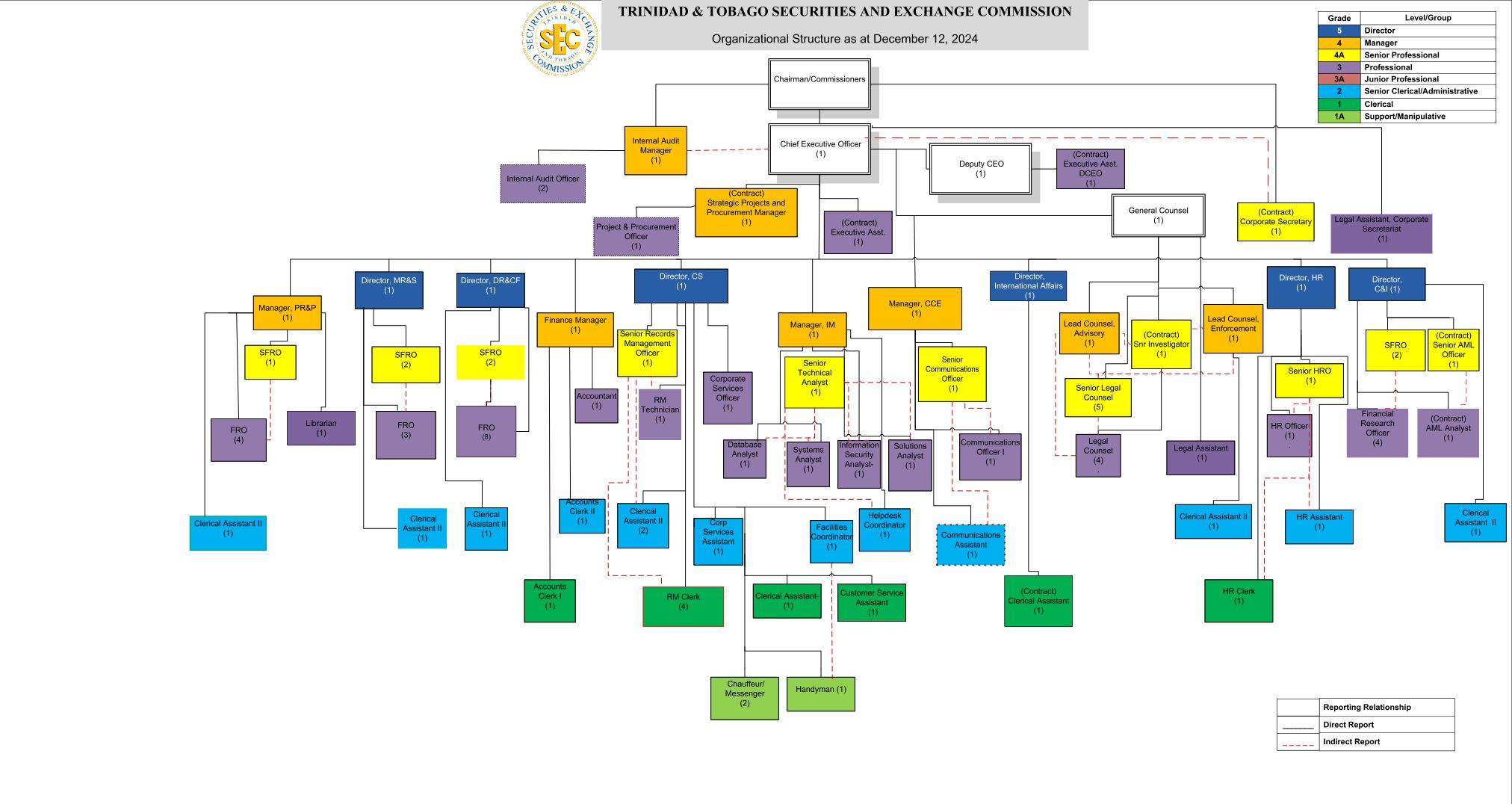

Organisational Structure